Rise in boutique research houses leads to an increase in analyst coverage for firms

One trend from 2009 has left many scratching their heads: analyst coverage actually increased for lots of issuers. Part of this is down to the growing number of small, independent research houses, commonly referred to as boutiques. As a result, IR departments have spent much of the past year getting up to speed on the new houses covering their stock, inducting analysts and heading off to unusual locations to meet with the upstarts.

Some of the analysts are already well known, like ex-Bear Stearns star Dana Telsey, who set up Telsey Advisory Group in New York, or Bill Lerner, the senior gaming analyst from Deutsche Bank now running his own boutique out in Las Vegas to be closer to the action. Others are less familiar, however, and it can be hard initially to work out precisely who to prioritize.

‘Certainly there are a lot of boutique firms that have popped up out there. I think it’s putting a burden on management teams to keep track of who’s relevant,’ says Don Duffy, president of financial communications consultancy ICR. ‘The best way to approach this is by finding out who the buy side respects and follows. The other thing people can do is take a look at how large the sales force is, how many accounts a boutique calls on and whether those calls generate a lot of buy-side activity.’

Firm warning

Some of the new boutiques might be lacking in expertise, warns Roger Pondel, chief executive and president of PondelWilkinson, the financial communications firm.

‘In theory, growth in the number of research boutiques and investment houses should be good for public companies and IROs alike; more choices, and perhaps lower fees on the banking side, should provide new opportunities,’ he explains. ‘That said, however, IROs must take the time to exercise diligence and, in some cases, exercise caution.

‘Many of the new entities were formed from necessity by out-of-work analysts and bankers. There are also start-up boutiques founded by less scrupulous folks who perhaps found themselves out of work for reasons other than the economic downturn. Some, particularly in the research arena, are preying upon smaller public companies, offering what appear to be enticing services – from non-deal roadshows to research reports – for a fee that, in turn, could denigrate credibility in the minds of investors.’

IR teams should also watch out for small houses that speak with the press to boost their profile, says Michael Waring, founder of IR consultancy MJW and a former head of financial communications at three FTSE 100 companies.

‘Make sure your program actively includes sell-side analysts known to talk regularly to the media, including those from smaller boutique research houses,’ Waring advises. ‘If a misunderstanding gets out there in published sell-side research, it may still be possible to correct this efficiently with the analyst and the buy side. If it has already been published in a press headline, however, the horse has bolted and any inappropriate reputational consequences may be much harder to address.’

To build a good relationship with each new analyst, Duffy recommends setting up some kind of induction program. ‘Most, but not all, analysts require an in-person meeting before they launch coverage,’ he says. ‘For those that don’t, I think it would be wise for companies to meet face to face, if they actually want the coverage and they think the analyst is good.’

Also be prepared to hit the road, perhaps to some unfamiliar locations. ‘You’ve got to look to the regional firms – there are a lot of good things going on there,’ comments Gene Marbach, group vice president at PR and IR firm Makovsky + Company. ‘I think Morgan Keegan, based in Memphis, Tennessee, is a good example – it has a great research department. These may not be the marquee names, the Goldman Sachs or the JPMorgans of the world, but they’re names you really have to put on your list if you’re targeting the sell side.’

Surprising statistics

The rise in analyst coverage is surprising to most market participants. Analyst numbers were expected to fall further in 2009 as the sell side experienced more cutbacks. Certainly this has been true for smaller companies: in the UK, some brokers completely abandoned the sector as trading volumes slumped. But for around half the companies in the UK and Asia, and a smaller proportion in the US, coverage has actually increased.

For example, take FTSE 100-listed Serco Group, the services company. During 2009 the number of analysts covering the company rose from 15 to 21. ‘I thought at the beginning of the year we would see less coverage, given the turmoil in the banking sector. But what we’ve actually seen is quite the opposite and I think that’s been the trend across the market,’ said Charles King, the company’s head of IR, at a recent seminar held by the UK’s IR Society. ‘Part of it is new guys setting up, so we’ve seen several new boutique brokers setting up shop and starting coverage.’

Lyndsay Wright, head of IR at William Hill, the gambling company, also spoke at the event, and agreed with King. For her firm, analyst coverage jumped from 21 houses to 27. King’s and Wright’s observations on the UK market are supported by the results of a survey conducted by the IR Society in September, which asked issuers whether they’d seen a change in the number of sell-side analysts covering their company over the previous 12 months. Some 39 percent reported an increase, 47 percent said coverage was unchanged and 14 percent noted a decrease.

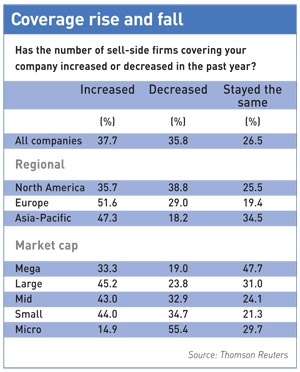

Changing coverage Data from Thomson Reuters released in November 2009 give a broader picture of the changing levels of coverage around the world. The firm conducted a survey of IR trends among more than 500 companies. It found that 52 percent of respondents in Europe have experienced an increase in the number of sell-side firms covering their stock over the past year. Some 47 percent of respondents from the Asia-Pacific region also saw an increase, although the number was smaller for North American companies, at 36 percent.

Data from Thomson Reuters released in November 2009 give a broader picture of the changing levels of coverage around the world. The firm conducted a survey of IR trends among more than 500 companies. It found that 52 percent of respondents in Europe have experienced an increase in the number of sell-side firms covering their stock over the past year. Some 47 percent of respondents from the Asia-Pacific region also saw an increase, although the number was smaller for North American companies, at 36 percent.

Despite the findings, Bill Haney, Thomson’s head of IR services, does not believe there has been a meaningful increase in the level of coverage for companies in developed markets. ‘Analyst coverage has stayed the same for the majority of firms, while those toward the bottom end of the market-cap range have seen a decrease, as well as a drop off in the number of sell-side conferences,’ he comments. ‘There are broader trends of increasing interest in emerging Europe and emerging Asia, which have been going on for a couple of years.’

If your coverage is increasing, says Waring, the set-piece analyst event becomes more important. ‘With extensive levels of analyst coverage, it is even more important that IR ‘set-piece’ disclosure – stock exchange releases, presentations, formal reporting, and so on – is as comprehensive and clear as possible,’ he notes. ‘It should have strong simple strategic and performance messages up front, addressing all major questions, backed up by all the necessary technical supporting information, readily accessible in person or via appropriate media tools, and should require minimal face-to-face follow-up to convey all the salient details.

‘Managing the days after a major announcement is not about disclosure; it is about ensuring the correct understanding of the company’s messaging. In terms of investor relations, this is often as critical as the announcement itself and should be planned well in advance. The process is really a microcosm of how to deal with the sell side generally – prioritization is always a juggling act, a matter of judgment and balance.’

Drilling down

A final factor to take into account is the depth of the research the boutiques often produce. Some of the specialist houses don’t do daily results notes, tending to concentrate more on longer in-depth notes on individual companies and trend pieces covering a whole sector. One example is Green Street Advisors, one of a number of US specialists that has crossed the Atlantic and set up shop in London.

To get the edge in their research, boutiques can be very demanding on IR departments, requesting access to many different areas of the business, particularly members of the operations team. Some IROs have welcomed this change. At the IR Society seminar, King pointed out that it makes a nice change from dealing with results notes.

‘We’ve seen longer, more thematic notes that have doubled or trebled in length, on average,’ he said. ‘We no longer get the, Well, revenue was this, and margin was that results notes that are published on the day. Now we’re getting notes that look across the sector, across companies, at themes within the sector.

‘For us I think that’s much better. It’s much more informative for our buy-side institutions and gives a good basis for debate.’

Ask the analyst

Bill Lerner is co-founder of Union Gaming Group, an independent research firm set up early in 2009 that also works as a government and industry adviser. He has 13 years of Wall Street experience, most recently at Deutsche Bank as senior gaming and lodging analyst.

Why do you think some companies have experienced an increase in analyst coverage? How much of it is down to the rise of the boutiques?

‘We have more gaming companies under coverage (17) at Union Gaming Research than we ever had at a large bank, and more than any of our current competitors. Part of this relates to our ability to cover companies across markets – US and Asia, for example – and across the market-cap structure (equity and debt) without an internal counterpart that executes in that role.

‘In an effort to differentiate ourselves from traditional competitors and to try to create incremental value, we have an interest in covering smaller-cap companies or companies in our sector that for various reasons are off radar screens. This could help explain it, too. Analyst coverage may also be increasing as existing analysts at the investment banks are being asked to cover more firms.’