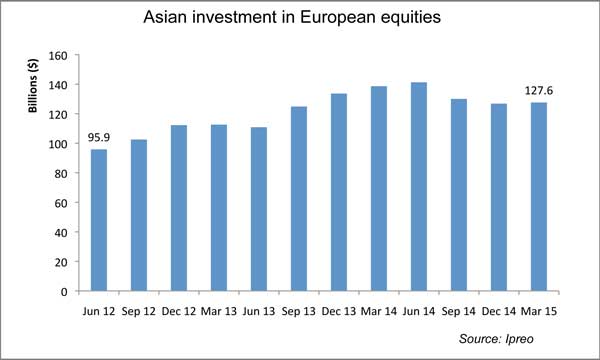

Asian investment in European equities rose by a third in the last 12 quarters, finds data from Ipreo

Asia’s equity investors continue to up their exposure to European companies, with government pension funds driving the latest wave of investment. Many European firms remain reluctant to travel to the region for non-deal roadshows, however, given the time and expense of such trips and the existence of more favorable opportunities elsewhere.

Last year Japan’s Government Pension Investment Fund, the world’s largest pension fund, announced it would shift its asset allocation toward stocks and also invest more internationally, following pressure from politicians to shake up its approach.

Around the same time, Korea’s National Pension Service, the third-largest pension fund in the world with roughly $400 bn in assets, said it would raise its overseas holdings from 20 percent to 30 percent over five years.

Overall Asian investment in European equities has climbed in the last 12 quarters by 33 percent, or nearly $32 bn, according to data from IR services firm Ipreo.

Looking at the stats by country, Singapore’s investment community holds the most European equity capital, with the bulk of its investment made through sovereign wealth funds (SWFs). Japan is the second-largest holder, and has recently been narrowing the gap with Singapore, notes Ipreo.

Along with increasing their ownership of European companies, certain Asian SWFs are taking a more active approach to investments. Three to five years ago they were essentially index investors in Europe, taking a small percentage of all the major indices, points out James Tickner, head of advisory services products at Nasdaq.

‘Some are now engaging with the management teams of their major investments a lot more, and also employing much more active strategies,’ he says. ‘We’ve seen them pull back in some areas and go overweight in others where they see real value in the long term.’

Despite this uptick in interest, however, the number of European companies going on the road in Asia has remained flat for the last couple of years, according to Nasdaq.

‘A lot of the practical issues that existed a few years ago still exist now: the distances involved, the costs,’ notes Tickner. ‘And of course there’s always the opportunity cost – [Asia] versus another trip to the East Coast or somewhere else where there are an abundance of investors in a small geographic area.’

Tickner advises IR teams to keep an eye on which Europe-based sub-advisers are being used by pension funds and others, handing companies the chance to tap into some of this new investment without traveling. ‘That’s a very efficient way of accessing some of that capital,’ he explains.

This subject will be under discussion at the IR Magazine Think Tank – Euro Leaders 2015, taking place on June 30 in London.