New partnership gives corporates deeper look into institutions making meeting requests

Phoenix-IR’s CorporateAccessNetwork has teamed up with targeting and tracking firm Investor Update to offer detailed shareholding information in near real-time.

The bespoke research service means IR teams receiving a meeting request through CorporateAccessNetwork can get additional pre-meeting information, including whether or not that institution owns the stock, as well as ‘the usual background stuff,’ says Adrian Rusling, partner at Phoenix-IR.

‘This is not stock ID in the broader sense,’ he explains. ‘The idea is to be very specific.’ So specific, in fact, that requests are made on a fund-by-fund basis for a fee of €250 ($271), though Rusling says there may be room for subscription services in the future.

CorporateAccessNetwork has more than 1,000 institutions on the network. And while an IRO may already know certain portfolio managers and will, of course, be familiar with institutions like Fidelity, for example, Rusling says ‘there are very few IROs who know 1,000 institutions, so there could be plenty of requests that might come through and leave an IRO wondering, Who is this?.’

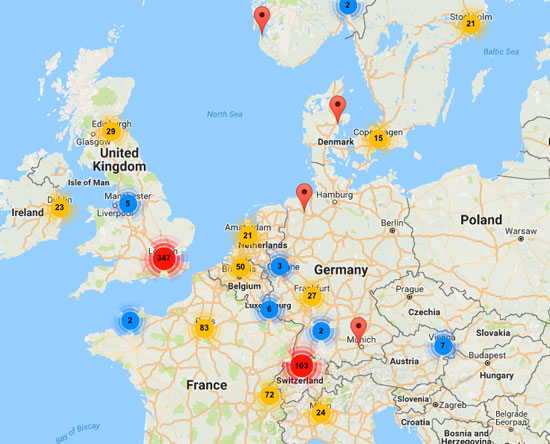

More broadly, Rusling says the network – which he describes as more social network than customer relationship management – is continuing to gain ground, with more than 76,000 meeting requests processed to date. There’s a roughly 50:50 North American to European split on the corporate side, but the institutions using the network are heavily concentrated in Europe where Mifid II regulation, set to come into effect in January 2018, is no doubt having an impact and where Rusling says institutions have been adding new corporate access methods well ahead of the regulation implementation date.

‘Last year we were processing 100 requests a day,’ he says (though that figure could include a single investor making 10 requests, for example). And the numbers continue to creep up: ‘So far in 2017, the average is 150 per day.’

So does Rusling see this sort of alternative corporate access taking over the old ways? ‘In a Mifid world, some people might [organize corporate access] themselves, hire someone in-house or maybe use an external IR agency,’ he says. Platforms like CorporateAccessNetwork and competitors such as ingage add another option to the mix – one Rusling says is likely to be an ‘and’ rather than an ‘instead of’. CorporateAccessNetwork’s interactive institution map

CorporateAccessNetwork’s interactive institution map