The amount of money being allocated to global equity mandates continues to rise. What does this mean for targeting strategies and the peer group companies sit in?

This year kicked off with a surge of interest in equities, including actively managed funds. But the longer-term story is less positive: investors have fallen out of love with stock pickers thanks to their high fees and years of poor performance.

One area of the active equity industry has proved resilient, however: fund managers investing on a global basis have seen inflows over the last several years and have increased as a proportion of the overall active equity space.

As a result, investor relations teams are increasingly coming into contact with this group, which may need to be approached differently from regional funds, given their broader investment outlook.

Funds in this area fall into two broad categories: global funds that invest in multiple regions, including a sizable portion in their home region, and international funds that invest globally but make few investments in their home market.

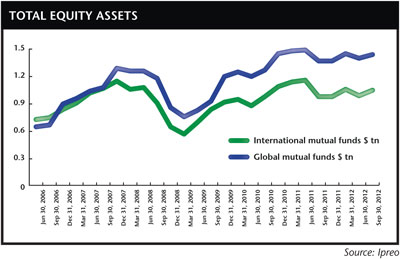

Data from Ipreo, the market intelligence firm, shows that global mutual fund assets have grown in size from $653 bn to $1.4 tn between 2006 and 2012, while international mutual fund assets have risen from $731 mn to $1.1 tn. Over the same period, global and international funds have grown as a proportion of all active equity assets from 21.5 percent to 28.4 percent.

The IR advisory team at Thomson Reuters has also been following this shift closely. ‘The big trend over the past few years has been a shift from active to passive equity funds,’ says James Tickner, global head of targeting at Thomson. ‘As active managers have struggled to justify their fees and with stocks so affected by macro concerns, it’s natural for money to flow toward lower-cost fund alternatives.

‘So the overall picture for actively managed equity funds has been pretty bleak, but within this there are some bright spots – one of which is global and internationally focused funds. When looking at actively managed funds in the US, for example, we can see that while the aggregate picture is negative, funds that have a global or international remit to invest have usually been far more resilient to redemptions.’

By following a broader pool of potential investments, fund managers have more opportunities to outperform the market, Tickner points out. ‘Investors want the flexibility to take advantage of opportunities around the world and not be tied to just one index or region,’ he says.

Growing fan club

The popularity of global strategies has led regional funds to broaden their own approach. Fund managers have been keen to benefit from the flows of money into global strategies, as well as take advantage themselves of the wider opportunities on offer.

And the tactic appears to be working. Ipreo conducted research last year that shows portfolios that are becoming more international have been among the biggest winners of inflows among active equity managers over the last five years.

Indeed, funds with a regional mandate may in fact have a substantial amount of ‘global’ investment. Robert Romanow, senior analyst at Ipreo, highlights Pioneer’s North American Basic Value Fund as an example: the $450 mn fund has 85 percent of its assets invested in North America and 15 percent in Europe.

‘One caveat here is: the bigger the fund, the less it is going to diverge from the prospectus and the name of the fund – if only for publicity reasons,’ says Romanow. ‘If a multi-billion-dollar fund says it is US equity, and then invests a lot of its cash in Europe, that might get called out, so a lot of these funds by nature are smaller, $1 bn or just over.’

When you’re looking for new targeting opportunities, global and international funds can offer exciting opportunities in terms of their size. ‘Looking at the regional allocations of some of the largest actively managed mutual funds in the world, it’s clear many of them adopt a global approach,’ says Tickner.

‘The Capital World Growth and Income Fund, for example – with $62 bn under management – has just 36 percent of its portfolio in North America, 38 percent in Europe and 26 percent in Asia-Pacific, Latin America and the Middle East.’

‘The global fund market has plenty of mutual funds that manage significant amounts of money,’ says Romanow. He points out that pension funds, which might be assumed to have a home-country bias, can often be overlooked. ‘The Ontario Teachers’ Pension Plan is close to $21 bn now in equity assets,’ he notes. ‘This pension plan invests about 10 percent of its assets in Asia, 25 percent in Europe, 10 percent in South America, and the remainder in North America.’

Targeting approach

While global and international funds offer exciting opportunities for investor relations teams, they also present challenges, given their broad outlook. Companies in these funds are being compared against a much wider range of stocks and asset classes than they might be used to.

‘Companies have to consider that they are competing for capital on a global basis with these funds, which are going to want – and expect – dialogue on global industry peers, not just those within the immediate domestic peer set,’ says Tickner.

‘The conversation clearly becomes much broader and IROs need to be equipped to engage on global sector dynamics. If you are a European pharmaceutical firm, for example, up to now you would be expected to give a viewpoint on the European market as well as some key US competitors. These days you are expected to fold the Asian pharmaceutical firms into that discussion as well.’

This shift in focus is also affecting how the sell side conducts research, notes Tickner. ‘We have heard from several sell-side firms that demand for globally focused equity research has been strongly on the rise,’ he explains. Oliver Schmidt, head of IR at German insurance giant Allianz, which won best overall IR by a large-cap company at the IR Magazine Awards – Europe 2012, says his company treats these funds the same way as everyone else, although conversations are on a much more general level as these ‘poor guys’ often have to ‘cover (almost) all sectors and countries’.

Oliver Schmidt, head of IR at German insurance giant Allianz, which won best overall IR by a large-cap company at the IR Magazine Awards – Europe 2012, says his company treats these funds the same way as everyone else, although conversations are on a much more general level as these ‘poor guys’ often have to ‘cover (almost) all sectors and countries’.

‘Therefore, the one-on-ones naturally focus on universal topics like dividend policy, net asset value sensitivity, rating or growth expectations,’ says Schmidt. ‘But I don’t produce a specific presentation; I just adjust flexibly in the meeting to the client’s knowledge level and information demand. These guys are less micro and more macro-driven, and if your sector is not the theme of the day, than you will have a hard time getting on the shopping list, even if you excel within your sector.’

Romanow advises companies to investigate which ‘hot’ regions global funds are shifting toward. ‘If a mutual fund has been increasing its exposure to one specific area, one specific region, that might be the opportune time to speak with its portfolio manager,’ he says.

It can also be a challenge to connect with the right person at global or international funds, given that the portfolio managers and analysts could be found anywhere in the world. ‘This is a question we get frequently, especially when traveling to some of the new areas in Asia,’ says Romanow.

‘People ask, Who can I meet there? And even if I do meet someone there, will he or she be the end-decision maker? The short answer is that it’s difficult to find this out, but overall we get a good picture of it based on the feedback we get from our clients.

‘In North America, the typical process is to go through analysts, as analysts here have lots of exposure to portfolio managers. In Asia, you frequently speak with portfolio managers. We’ve noticed the global brand name banks, however, are the ones that might maintain some of the decision-making power in their head offices, be it Boston, San Francisco or London. It’s really a case-by-case basis; there isn’t a blanket statement that covers them all.’

‘If a portfolio manager for a global fund wants to understand your Asian business better, consider having him or her meet local Asian management,’ suggests Tickner. ‘This also applies if there are sector analysts who are based in other geographic locations.’

As equity investment becomes increasingly global in nature, perhaps the biggest challenge for companies is that they now compete with a much bigger group for capital. ‘That’s really something to be aware of,’ says Tickner. ‘Always try to replicate the lens the buy side is looking at you through, so if it is taking a global view of the sector, that’s how you should communicate, too.’

Free reinOne example of a fund that can invest anywhere and in just about anything is the $26 bn Ivy Asset Strategy fund. As the portfolio managers don’t have any specific mandate, the regional allocations, as well as any sector bias, shift from year to year, so the key is identifying the regions the fund is flowing into, notes Robert Romanow, senior analyst at Ipreo.Fund name: Ivy Asset Strategy Fund Portfolio managers: Michael Avery and Ryan Caldwell Fund assets: $26 bn Equity holdings: 48 Median market cap: $39.5 bn Portfolio composition: Foreign common stock 42.76%, domestic common stock 39.75%, other assets 10.09%, cash and cash equivalents 2.97%, corporate bonds 2.47%, senior loans 1.94%, government bonds 0.02% Top five equity holdings: Sands China 5.1%, Volkswagen 4.7%, Wynn Resorts 4.4%, Galaxy Entertainment Group (ADR) 3.8%, AIA Group 3.7% Top five country allocation (as a percentage of equity holdings): US 48.2%, China 14.2%, Hong Kong 9.0%, Germany 8.9%, UK 5.5% Details correct as at December 31, 2012 Source: Ivy Funds |