A first look at our upcoming research highlighting changes to the typical investor base and analyst coverage

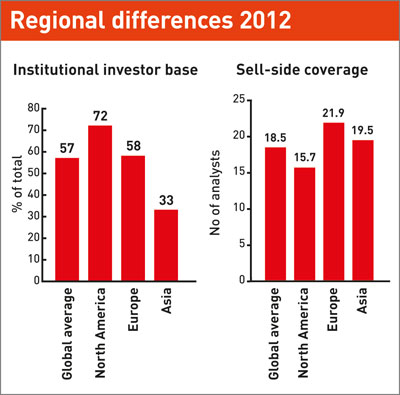

On a global basis, a typical company’s investor base now has fewer institutional investors than last year. While institutional investors are still the single largest shareholder group, once again accounting for more than half of all shares, their current 57 percent stake is down from 63 percent in 2011.

Individual shareholders largely make up the shortfall, moving up five percentage points to 29 percent. Meanwhile, state and sovereign wealth funds have increased the size of their holdings to 8 percent, up from 7 percent in 2011.

Alongside these changes to investor profile, the average number of sell-side analysts covering firms is marginally up in 2012. The main change is at mega-cap companies, where coverage has increased from 28 to 29 analysts per company.

Each of these findings comes from the IR Magazine Global Practice Report 2012, due to be published at the end of October. As usual, the report analyzes IR practice globally as well as regionally and by market cap size.

The three regions covered in the report are North America, Europe and Asia. Unsurprisingly, IR departments in each of these regions have a different mix of investors and analysts to service.

The investor profile for North American and European companies has largely remained consistent, year on year. In North America, the level of institutional share ownership remains at 72 percent, and state or sovereign wealth ownership remains the lowest of the three regions at 2 percent.

In Europe, institutional investors continue to hover around 58 percent and individuals make up a little more than a quarter (27 percent) of the base.

The most significant change has been in Asia, where institutional investors account for a third of all share ownership, down from 39 percent in 2011.

Conversely, the percentage of shares owned by individuals is currently 41 percent, up from 32 percent. Company founders and their families account for nearly two thirds of the shares owned by individuals. State or sovereign wealth funds account for a fifth of overall share ownership in Asia.

The average number of analysts covering North American companies has fallen for all cap sizes, except mega-cap firms. Sell-side coverage of these mega-cap companies is typically 25 analysts per company, an increase of one analyst compared with 2011.

North American large-cap companies have seen the biggest fall in analyst coverage, shedding an average of two analysts per company.

In Europe and Asia, by contrast, analyst coverage is up across the board: Asian small caps and Asian large caps report the biggest increase in coverage, gaining three additional analysts apiece.

European companies, however, still tend to be the most-covered firms: small caps in Europe have nearly twice as many analysts covering them as their North American counterparts, while European mega-caps have the highest coverage of any cap size in all three regions.