70 percent say operating cash flow an important factor in investment decisions, finds PwC

The availability of operating cash flow is an important factor in making investment decisions for 70 percent of potential shareholders, according to a survey conducted by PwC.

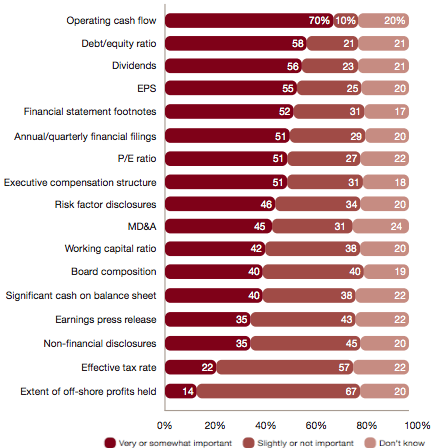

PwC’s 2013 Investor Survey, carried out by the firm’s Investor Resource Institute, also finds that a majority of investors consider a good debt to equity ratio, dividends and EPS to have a bearing on which ventures they choose to invest in. The value of off-shore profits held by companies is resoundingly the least important factor.

The survey asked a range of investors to rate how important different types of information is in making decisions for their investment portfolio:

Source: PwC Investor Survey, 2013

Investors also name analyst reports as the most crucial document for making such decisions, with earnings guidance almost as integral. However, 62 percent of respondents say that they rarely rely on consensus estimates to sway their opinion.

The survey also asks shareholders to name the areas of focus they would like to see from company directors. Almost every investor questioned says that risk management (97 percent) and strategic planning (95 percent) are the most or very important factors, along with executive compensation (88 percent) and succession planning (86 percent). IT strategy and risks are widely seen as the least important factors.

Along the same lines, 94 percent of those questioned say that risk management expertise is the most important skill a board member could have, should they want an investor’s backing.

‘Investors are looking at risks differently than in the past,’ reads PwC’s report. ‘The financial crisis that affected capital markets across the globe demonstrated that companies – and even whole economies – can be rocked to their core when the connections between lending practices, securitizations programs, and capital and funding levels are not clearly understood and monitored.’

Respondents to the survey largely represent government pension funds (40 percent), with 17 percent comprising investment and asset managers. A further 8 percent of those surveyed work in labor pension funds, while 6 percent work for insurance companies. The rest represent alternative fund managers, commercial and investment banks and other funds.