What combination of investors works best for a given company in a given place at a given time?

Even though the question has no definitive answer, only guidelines and rough guesses, IROs haven’t given up trying. ‘We get asked a lot, What’s my ideal shareholder base?’ says Brian Matt, director of data strategy and analytics for Ipreo in New York. ‘Everyone’s always looking for a way to measure the contribution of investor relations. If you can set a goal and determine an ideal shareholder base, you can take steps toward achieving it. But it’s a very complicated question because x percent concentration of a particular type of investor isn’t right for everyone.’

‘Everyone’s always looking for a way to measure the contribution of investor relations. If you can set a goal and determine an ideal shareholder base, you can take steps toward achieving it. But it’s a very complicated question because x percent concentration of a particular type of investor isn’t right for everyone.’

Perhaps fittingly for a process that’s more art than science, many of the metaphors come from the world of matchmaking. Julian Cassells, president of Alpha Advisory Associates, puts it this way: ‘You have to marry a company’s fundamentals with the complementary shareholder base.’

Matching shareholders to strategy

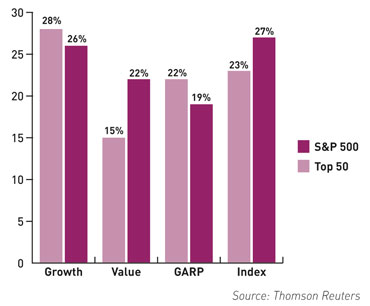

That said, it’s the specifics IROs are truly after. To this end, Thomson Reuters’ James Tickner, head of global investor targeting, and Chris Collett, global head of advisory services, analyzed the shareholder bases of the 50 best-performing companies within the S&P 500 over the past five years. As they predicted, the top achievers had higher percentages of growth investors than the typical S&P 500 company (see below).

Shareholder base breakdownThe data shows a comparison between the make-up of the shareholder base of S&P 500 companies and that of the 50 best-performing companies within the index over the past five years. |

On the other hand, they found far less difference in the levels of international shareholders than they had expected. And while IROs often want to attract longer-term investors, it turns out that the best-performing companies actually have a slightly higher proportion of short-term investors.

Before IROs can determine the ideal investor mix, they need a good basic handle on their existing shareholder base. Lucas Scheer, president of LS Global Advisory Group, a boutique capital markets intelligence provider based in New York, says this understanding is important but doesn’t need to be comprehensive because IROs inevitably have blind spots. ‘The question is: what size is that black hole? If it’s 30 percent of ownership, can I narrow that down to 10 percent?’ he says.

IROs hiring consultants to help them identify shareholders often come away with additional information that proves useful. For instance, knowing when a shareholder initially bought shares and at what price gives a rough idea of what that investor’s exit price might be, adds Scheer. Cassells suggests IROs revisit their shareholder make-up once a year. Matt seconds the idea that identifying shareholders annually makes good sense. ‘At absolute minimum, once a year most companies are going to have to face investors in a shareholder vote,’ he points out. ‘You really should know who the investors are that will be voting for the board and shareholder proposals.’

Cassells suggests IROs revisit their shareholder make-up once a year. Matt seconds the idea that identifying shareholders annually makes good sense. ‘At absolute minimum, once a year most companies are going to have to face investors in a shareholder vote,’ he points out. ‘You really should know who the investors are that will be voting for the board and shareholder proposals.’

In addition, Richard Davies, managing director of RD:IR, a London-based independent IR consultant, urges IROs to commit their shareholder mix strategy to paper. ‘It helps to have a written document that sets out what you’re trying to achieve, when you’re trying to achieve it, and why you’re trying to achieve it,’ he says. ‘Doing this gives structure to the process in the minds of the IR team and senior management, and sets out an agenda for the process.’

Retail vs institutional

When determining mix, there are a few classic dichotomies, such as size (retail vs institutional), investment style (value vs growth) and geography (domestic vs international). Although institutions own the vast majority of shares in most public companies, having retail investors in the mix is often desirable.

Retail investors have earned a reputation for loyalty, and they also contribute to a company’s name recognition. ‘While institutional ownership should overwhelmingly dominate the float, retail investors, especially foreign retail investors, can make more people in their regions aware of your company,’ says Scheer.

According to Simon Courtenay, managing director of London-based Broker Profile, roughly 10 percent of the shareholder rosters of FTSE 100 companies are owned by retail investors, often through private client stockbrokers.

Unlike in the US, where retail investors tend to make their own investment decisions, in the UK, private client fund managers control £450 bn ($720 bn) worth of assets – more than 80 percent of the retail market, Courtenay says.

For companies trying to expand their retail ownership, the dominance of private client brokers in the UK is good news indeed. Courtenay points out that IR professionals can form relationships with these brokers, much as they would with their institutional counterparts, and these advisers tend to have very long investment horizons.

A question of style

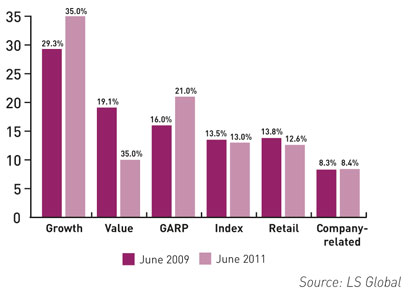

For some companies, the style of investor to pursue is a foregone conclusion, determined almost exclusively by a company’s industry and financial outlook. ‘If you’re a utility company, there’s a ceiling on the percentage of growth managers you’ll have at any one time,’ acknowledges Scheer. But for industries with strong financials and appealing growth prospects, he says having twice as many growth managers as value managers is achievable.

Shareholder base evolutionAt the start of the 24-month period beginning June 2009, this company’s IR efforts sought to increase the level of growth-oriented investors, and began a targeting strategy focused on attracting appropriately screened and qualified growth-style institutions. |

By studying S&P 500 companies, Tickner and Collett discovered that the 50 best performers have a shareholder base that is 28 percent growth investors, compared with 26 percent for the S&P 500 as a whole. Similarly, the top 50 companies have only 15 percent value investors, relative to 22 percent for the broader index.

Beyond the annual review of the shareholder mix, IROs need to ask themselves these questions whenever a large corporate event, such as a new acquisition or takeover attempt, is on the horizon. Large-scale M&A activities will alter the financial profile of a business and may tilt the future shareholder mix dramatically.

A shift in IR strategy might also prove pivotal. ‘If I’m changing the drivers of my investment story, there are certain investors that will like those changes and certain investors that won’t be very happy,’ Matt explains.

‘We advise companies to think about what they believe their investment story is going to be over the medium to long term,’ says Tickner. ‘What will the company be doing with cash flow, for example? Will it be returning it to shareholders via buybacks, dividends, bolt-on acquisitions or transformative deals?’ The answers to these questions determine which shareholders make the best fit.

Domestic vs international

‘Geographic diversification is one of the broader investment themes of the last 10 years,’ says Matt. ‘Over time, we have seen greater allocations toward the international and global portfolios of major mutual fund managers.’

Although the numbers of international investors on shareholder rosters have increased, their representation remains relatively modest, maintains Collett. He cites a popular notion that the representation of overseas investors in a company’s shareholder base should correspond with the proportion of revenues generated abroad.

‘That’s just not realistic,’ he says, explaining that in 2011, 46 percent of revenues for S&P 500 companies were derived outside the US. Tickner and Collett also point out that companies generating more than 20 percent of their income from Asia rarely see Asian ownership rise above the mid to high single digits.

Foreign ownership percentages don’t have to equal revenues, but this disequilibrium should spur IROs to ask some sobering questions. ‘If a sizable part of your revenues is coming from Asia or Europe, are you attracting some investment, even if it’s not equivalent to the amount of revenue?’ asks Collett. ‘It’s a good question to ask yourself: are we really unlocking the value of our local presence or brand in some of these international markets?’

Rethinking the mix

When mulling shareholder mix, Thomson Reuters advises IROs to identify an aspirational peer group, companies they can’t quite compete against today but would like to compete against in the future. Tickner and Collett recommend examining the investor bases of these aspirational peers – and considering how to appeal to the same kinds of investors.

Many believe the conventional wisdom on investment horizons is due for revamping. ‘While the common perception is that long-term, stable holders are always the more desirable, we would argue that you want to match your target investors with the strategic direction of the company,’ Collett and Tickner say.

They point out some companies face tough trade-offs: to attract the largest institutional investors, a company needs adequate liquidity, but targeting long-term investors won’t give a company the necessary liquidity for some of the largest firms.

Beyond the traditional classifications, some companies are seeking out whole new groups of investors. ‘Corporate governance performance is the really big topic right now,’ says Cassells. A savvy IRO at a company with a good governance track record might want to target SRI funds, she suggests.

IROs might also try viewing shareholder mix much as stock exchanges and professional traders do. ‘What you’re really trying to do is build a deep and broad market,’ explains Matt. ‘Market depth means you have buyers and sellers available at all price points near your present price.’

Specifically, he suggests that a company wants buyers should its shares decrease 1 cent, 5 cents, 10 cents or 20 cents below the last tick, and investors available to sell when they rise at the same increments.

Market breadth builds an investor base that’s ‘more insulated against event risk,’ adds Matt. The deeper and broader one’s shareholder base, the less volatility a stock should experience. Again, says Matt, the concepts are intuitive: having 10 shareholders that each own 10 percent of the outstanding shares makes a company far more vulnerable if and when someone jumps ship.

‘What it all boils down to is that an extremely concentrated shareholder base is at risk from a move from one investor or a very small number of investors,’ he concludes. ‘A more diverse shareholder base is a bit more immune to that impact.’

All agree that moving a company’s shareholder mix closer to the ideal requires tremendous effort. Landing the ideal investors for a shareholder register requires analysis, judgment, strategic thinking and hard work.

‘Getting the right investors is like putting together a jigsaw puzzle,’ says Davies. ‘You have to have great advice, and then you have to put resources and real effort into achieving your strategy.’