Small investment houses are growing in significance as assets move from index trackers toward small stock pickers

By definition, boutique investment houses hold only a small proportion of all funds under management. But the percentage is rising as some assets migrate from large, passive index trackers toward small, active stock pickers. This trend, in evidence for several years in the UK, has accelerated since last summer, when the credit crunch began. Big financial institutions no longer look like such safe bets, and more money is going to smaller players.

On the plus side for IROs, many boutiques are long-term, long-only investors: don’t automatically think ‘hedge fund’. IROs may, however, face more scrutiny from boutique managers compared with larger institutional investors. That’s because boutiques live and die by their investment decisions. They cannot afford to blindly follow the lead of management, as some larger investors may choose to do.

‘If companies are being cute about their capital structure, we’ll tend to avoid them,’ says Jonathan Compton, director and fund manager at Bedlam Asset Management, a UK boutique with £250 mn ($498 mn) in assets under management. ‘In the old days, you’d have 10 big shareholders, do a rights issue or a placing, and bang – they’d all take it. Now you’ve got boutiques saying, Perhaps I’m not interested. If anything, having more boutiques should generally increase levels of corporate governance and corporate transparency. That is a hoped-for and possible outcome.’

Andrew Parry, CEO and COO of Sourcecap, a boutique based in a converted brewery on London’s Brick Lane, agrees that smaller investment houses may influence the relationship between companies and investors.

‘There is a tendency among the big holders of UK stocks to generally support management,’ Parry says. ‘They don’t want to rock the boat too much. On the other hand, boutiques are much more aggressive and performance-oriented. They don’t have a semi-passive approach, and they want to make sure they maximize their returns on selective investments.’

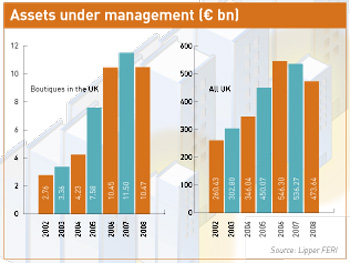

Asset gathering Statistics from fund management research firm Lipper FERI show a surge in assets held by UK boutiques over the last five years (even considering a slight fall in the last 12 months, in line with the industry as a whole). Total assets under management in the UK roughly doubled in size between 2002 and 2007, while assets held by boutiques quadrupled (see Assets under management, right). ‘The development of the assets of boutiques over the last five years has really expanded quickly,’ says Sophie Pruvost, a research analyst at Lipper FERI.

Statistics from fund management research firm Lipper FERI show a surge in assets held by UK boutiques over the last five years (even considering a slight fall in the last 12 months, in line with the industry as a whole). Total assets under management in the UK roughly doubled in size between 2002 and 2007, while assets held by boutiques quadrupled (see Assets under management, right). ‘The development of the assets of boutiques over the last five years has really expanded quickly,’ says Sophie Pruvost, a research analyst at Lipper FERI.

Continental European boutiques saw an even bigger jump in market share. Total European assets rose by a little over one and a half times in the same period, while European boutiques jumped by around seven times.

Compton says the two main factors pushing assets toward UK boutiques are the decline of big banks as safe investment havens and the likely bear market. ‘Simply by doing nothing, we’ve become more popular,’ he explains. ‘That’s not because our performance is good – although it is – but because the opposition is committing suicide as fast as it can.’

Compton also says a bear market will push more money his way. ‘In bull markets, you don’t worry so much about fees or investment performance,’ he adds. ‘Now, there is a clear move toward stock picking – proper analysis as opposed to index slicing. Undoubtedly, there is a trend out there.’

Investment strategy

Most equities boutiques run active strategies and are more likely to pick stocks than track indexes. In addition, pay and performance are often closely linked. ‘People are looking for stronger performance, and this is more likely when fund managers are well incentivized,’ says Patrick Seth, head of institutional sales and client services at multi-boutique shop JO Hambro Capital Management.

When it comes to access, Seth feels senior management have been happy to give more time as boutique assets expand. ‘From our side of the fence, we have got better access to companies, finance directors and CEOs as we have grown as a business,’ he comments. ‘I would not say boutiques are more demanding than other investors.’

Despite this, IROs should be aware that the investor landscape is shifting. The clever minds that once ran big funds at large investment houses are increasingly found running their own boutiques. ‘Management needs to be aware that there are influential thinkers in the boutiques,’ cautions Parry.

The growth of the boutique industry will not dramatically change the daily routine of IROs. The assets they hold remain a small part of the total amount under management. Furthermore, many boutiques are long-only investors, relying on research rather than trading to make returns. In general, boutiques will not add to share price volatility.

Each one is different, however. Some employ tight, well-defined trading strategies, while others take a broader approach. Some put companies under intense scrutiny to justify taking large positions. IROs need to uncover their idiosyncrasies one by one.

What does draw boutiques together is their active investment strategy. Managers are paid according to performance and may not offer companies support off the cuff, like some larger shareholders. This makes investor communication all the more important for boutiques.

Defined by difference

Defining a boutique is notoriously difficult. Fund management research firm Lipper FERI defines a boutique as an asset manager with fewer than 10 funds and less than €5 bn ($8 bn) under management. Others define boutiques by reference to their investment style and management. Common characteristics include focusing on one particular sector or region and linking pay closely with performance.

Further complicating matters, some big asset managers describe themselves as multi-boutique shops. Examples include the Bank of New York Mellon’s asset management division, which gives each boutique under its control the autonomy of an independent investment house.

Andrew Parry, CEO and COO of Sourcecap, welcomes the ambiguity of the term. ‘I hope there isn’t one set of characteristics, as boutiques are generally run by managers who want to do their own thing and don’t want to be held back by the bureaucracy of the industry’s behemoths,’ he says.