IR professionals need to go beyond thinking outside of the box when it comes to retargeting investors and broadening the shareholder base, according to the latest IR Magazine Think Tank – East Coast.

At the event held in New York on April 27, IR experts were encouraged to think beyond current IR strategies and explore a differentiated targeting approach to re-engage investors.

‘It is important to keep in mind that there's different ways to approach a creative targeting exercise,’ said an IR professional at the event.

‘Whether it's completely rethinking a peer group, leveraging or utilizing different peer groups, or getting super specific and hyper focused on a specific strategy which aligns best with your company and your company specific current state or state in the market.’

Fruitful results

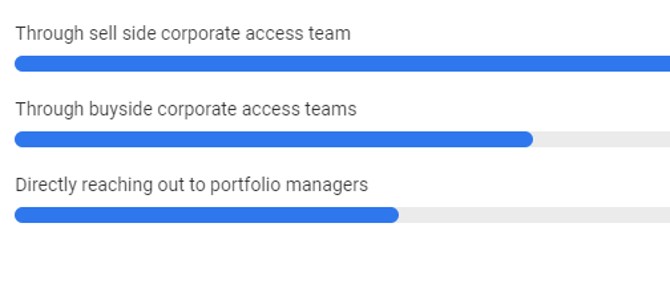

During a panel session, delegates were asked to vote on what they thought was the most successful way to set up investor meetings.

IR members were given the options: Through a sell-side corporate access team, through buy-side corporate access teams or by directly reaching out to portfolio managers.

The poll ranked going through a sell-side corporate access team as the most popular option. For small-cap companies, one question posed by the audience concerned how to ‘cut through the noise’ and reach out directly to the buy side if you don’t have a sell-side network.

‘As a small-cap company, all else being equal, you're probably facing more of an uphill battle in terms of garnering interest from investors relative to larger-cap companies,’ a speaker said.

‘This environment really plays and lends itself well to IROs who are more proactive. I think it might require a little bit more time and effort to do the digging. But if you find these investors, it can yield really fruitful results.’

Managing expectations

Measuring the success of sell-side and buy-side meetings beyond investors purchasing stock can be a challenge for IROs, explained an IR professional.

‘A successful meeting is one where we can get feedback from the company, where we know our investment professionals were prepared, and the meeting was not only useful for it and its management team but also for us,’ said a delegate.

‘Interesting questions were asked, [the company] may have heard something, it may have gotten a question from us that it hadn't heard before. And I think that's telling us about the preparation of our analysts and our training.’